Many companies have issued similar warnings. A new FT-ICSA survey of confidence of listed businesses found that the majority of British boards expect the UK economy to deteriorate over the next 12 months and that two-thirds of FTSE 250 company secretaries expect the UK economy to decline, with almost 60 percent saying their companies would be damaged by any form of Brexit. A survey earlier this year of more than 2,000 firms by the employment agency ManpowerGroup, which the Bank of England and the government use as an early warning indicator, found that a growing number of companies were preparing to cut jobs across the country. The poll of nine different industry sectors found that companies in finance and business services, which account for nearly a fifth of British workers, were among those preparing to make redundancies.

Some of the country’s biggest businesses have already announced plans to cut job or beef up their European operations with many putting provisions in place as they await an outcome on negotiations ahead of the October 31 deadline. Airbus’ announcement this year that it is weighing up its future in the UK has sent shockwaves across the political spectrum. Chief executive Tom Enders warned in January that the firm which employs 14,000 people in Britain, warned in January that the firm could be forced to start shutting down UK plants and attacked the government for prevailing the state of chaos. Britain’s second-largest insurer announced in February it will move £7.8bn worth of assets to Ireland as it prepares for Brexit. The US lender is spending $400m to move staff out of London, with Paris its preferred new European headquarters. Barclays bank moved $166bn of its clients’ assets to the Irish capital, stating that it could not wait any longer to implement Brexit contingency plans. British Steel announced 400 job cuts in September 2018 blaming the weakening of the pound and the euro which has made the raw materials it uses – all traded in US dollars – more expensive. In May 2019 the company said it risked going into administration, putting more than 4,000 jobs on the line. In June 2019, Ford announced that it will be closing one of its UK plants in Bridgend in 2020. This came on the back of Honda’s decision to bail out of the UK, leading to the loss of 3,500 jobs. BMW has previously warned that a no-deal scenario might force it to stop making the Mini at its Cowley plant near Oxford, putting more than 4,500 jobs and more than 100 years of car making at the site at risk. And earlier this month the boss of BMW urged Boris Johnson to respond to calls from business to find a compromise on Brexit. Japanese electronics’ manufacturer Panasonic announced that it will be moving its European HQ from the UK to The Netherlands, in a move designed to limit tax issues linked to Brexit. Sony is another Japanese tech company that has stated its intention to move its European headquarters from the UK to the Netherlands, in a bid to avoid disruptions caused by Brexit.

NO-DEAL COULD DESTROY 'MANY THOUSANDS' OF JOBS

Despite years of negotiations, the prospect of a no-deal Brexit remains a real possibility after Boris Johnson this week proposed suspending the UK parliament for at least a month to curtail efforts by MPs to prevent a no-deal Brexit on October 31. Chief no-deal planner Michael Gove has admitted the government is “working on the assumption” that will be the outcome. Business Secretary Greg Clark has warned that a no-deal Brexit will destroy thousands of jobs. “It’s evident that if you have the disruption that comes from a no-deal Brexit there will be people that will lose their jobs. It’s many thousands of jobs. Everyone knows that.”

Asked about claims the UK could weather a no-deal exit on World Trade Organization terms, Clark said: “I think every person that considers the evidence that companies have given – whether it’s in the automotive sector, whether it’s in the food sector, whether it’s in aerospace, in industries up and down the country – you know if you become less efficient and your ability to trade is impeded, then of course losing your competitiveness means there will be jobs lost.”

Ireland’s Finance Minister says that the country faces 85,000 potential job losses and a sharp economic slowdown if the UK crashes out of the EU in October. Paschal Donohoe said 50,000 to 55,000 jobs could be lost within two years of the UK leaving without a deal, with another 30,000 at risk in the medium term if there were no resolution to political chaos in Westminster over Britain’s departure from the bloc. The Central Bank forecasts 100,000 fewer jobs over the next ten years as a result of a disorderly Brexit.

The Bank of England, together with most economic forecasters, believes that a no-deal Brexit will leave Britain worse off. It predicts that the pound would fall, pushing up the cost of imports with this feeding through to higher shop prices. It also sees house prices falling by 30%, inflation spiraling to 6.5%, the pound plummeting to near-parity with the dollar, 100,000 people emigrating and unemployment nearly doubling.

BREXIT IMPACT ON THE REST OF THE EU

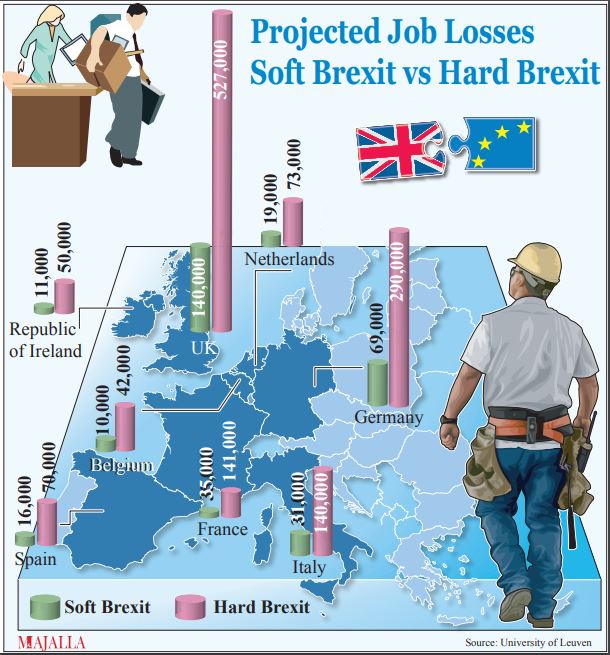

While the UK will feel the largest impact of no-deal, it would be fallacious to say that the rest of the EU-27 won’t feel any aftershocks whatsoever. After all, up to this point, the EU has been the UK’s largest trading partner; in 2018 UK’s imports from the bloc accounted for £345 billion, so if the UK were to crash out without a trade deal then many of the EU-27 could face major losses from their gross domestic income. While studies and reports have been conducted on the immediate impacts a no-deal would have on Britain and its economy, the possible outcomes on the wider EU economy have been largely glossed over. A recent academic study from the University of Leuven, Belgium, anticipates 525,000 UK job losses if the UK crashes out of the EU without a deal, meanwhile, 1.2 million jobs would be lost across the rest of the EU-27. Given this possible scenario, it should not come as a surprise that the EU and its member states have been trying to salvage a deal with the United Kingdom, particularly one that can stall Britain’s exit from the customs union until a more both parties negotiate another trade deal, rather than resorting to more cumbersome World Trade Organization (WTO) customs laws. A no-deal Brexit will be devastating, not just for British businesses and employees, but for business around the continent as a whole.

GERMAN AUTOMATION ON A COLLISION COURSE

With the exception of Britain, Germany would be the worst affected country from a no-deal Brexit. According to the Leuven University report, 290,000 German residents could potentially lose their jobs if Britain crashes out without a deal. The same study indicates, that a soft Brexit (which the authors assume would mean Britain remains in the customs union and EU single market), would only result in 70,000 job losses in Germany.

Germany is by far the UK’s largest trade partner in the EU, as the former exported 75 billion pounds worth of goods to the latter in 2016. Since the German economy is largely based on manufacturing, losing seamless trade with a large export market like Britain is a cause for concern in Berlin. A no-deal Brexit will also have bleak effects on Germany’s famed automobile industry since the UK serves as the largest export destination for German cars, in 2016 Germany exported 800,000 cars to Britain which essentially accounted for 20 percent of its global car exports. A study conducted by the Halle Institute for Economic Research indicated that there are 15,000 employees in the German car industry who directly or indirectly for exports to the UK, that roughly accounts for 0.9 percent of the industry’s workforce. As such, a hard Brexit could result in almost one percent of employees to be made redundant. Trade between the UK and other EU countries would likely be based on World Trade Organization (WTO) rules, which means that the UK would have to pay 10 percent tariffs on German cars. Moreover, major automobile districts such as Wolfsburg (where Volkswagen headquarters is located) and Dingolfing (which has a large BMW plant), will face financial setbacks from a no-deal.

FRANCE SEES A SILVER LINING

France would be the second-worst affected country in terms of total job losses, as 140,000 French residents are projected to be laid off in the event of a no-deal while only 35,000 people lose their jobs if a deal is put in place. Again if the free trade between the UK and EU member states stopped, then WTO rules would be applied after October 31. France is the UK’s fourth-biggest trade partner, and top Britain’s top imports from France include vehicles, car parts, planes, wine, and medicines.

Earlier last year, France’s finance minister Bruno Le Maire said that he expected Paris to overtake London as a major financial hub since many businesses are seeking to move out of London amid the uncertainty from Brexit. As such, he announced that several thousand jobs would likely be relocated to France. He did note that the shift would happen gradually rather than abruptly, and prospects of businesses moving did seem less likely when the prospect of a no-deal was more dubious early last year. However, as no-deal now appears to be certain, then Paris and Frankfurt, Germany might gain some of the lucrative businesses that are based in London.

SMALLER POPULATIONS TAKE BIGGER HIT

Because of their large populations, Germany and France would face the most job losses. But, according to the Leuven University study, a no-deal Brexit would have a greater impact on smaller EU countries, as the job losses on their smaller workforces can potentially lead to worse economic outcomes for them. As such, EU member states like Ireland, Malta, the Netherlands, and Belgium would face greater GDP declines. In the event of a no-deal, Ireland would shed 50,330 jobs - more than 2.5% of its workforce - and losing £9bn of value from its economy, this would translate to a GDP loss of 5.74 percent. In contrast, under a soft Brexit job cuts across Ireland would be significantly lower at around 11,000. Meanwhile, a hard Brexit would cause 1.2 percent of Malta’s workforce would lose their jobs (4.86 percent GDP loss) and 0.8 percent of Belgium’s workforce would face layoffs (2.35 percent GDP loss). Meanwhile, Germany and France would technically face more job losses, but in terms of their sizes, they would only face a GDP loss of just 1.76 percent and 1.25 percent, respectively.

It is evident, that a no-deal Brexit will have massive short term impacts on the economies of the UK and the EU-27, however, if the EU reshuffles its budgeting policies and more businesses relocate to new headquarters, then the bloc would probably recover on the long term. It’s difficult to have the same optimism with the UK, as it stands Johnson has decided to shut down parliament mid-September just to make it difficult for opposition forces to prevent a no-deal. If no new deal is negotiated by October 31, then the UK will be on worse terms with the bloc and it is unknown how both parties will go from there. But one thing is for certain, the UK will face the most traumas on the short term and quite possibly the long term.